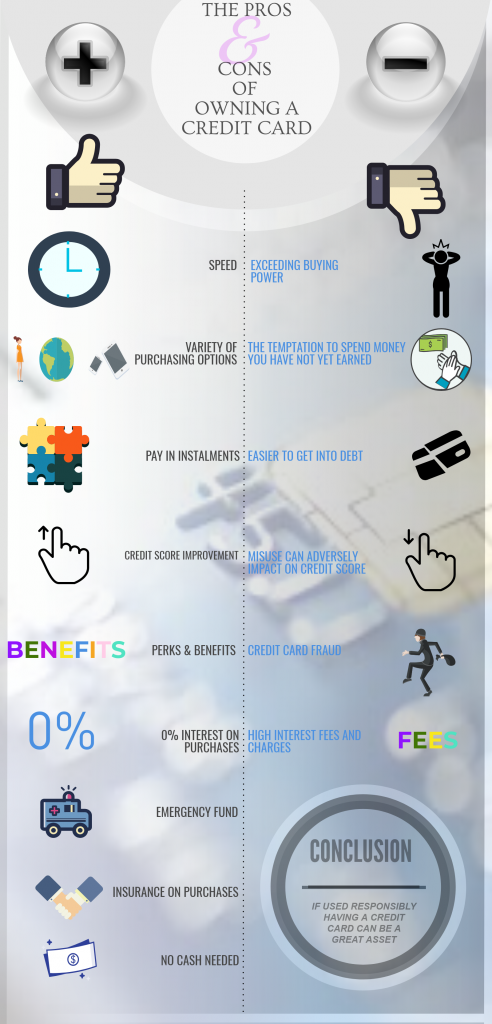

One of the most common forms of consumer debt today is the credit card. If you are thinking about taking out a credit card on your own, it is important to make sure that you know how to use it correctly. There are several advantages and disadvantages of credit cards that you need to be aware of and take into consideration.

Rewards and Points

One of the main benefits of having a credit card is that it can provide you with a variety of rewards and benefits. Many providers today offer users of a card a certain amount of points each time they make a purchase. These points can then be redeemed for cash back, free flights, and a variety of other benefits. As long as you do not waste money on interest, this is basically free money.

Convenience

Many people also like to have a credit card because it is very convenient. When you need to make a purchase, using a credit card is much easier than trying to carry cash or write checks. Further, through the use of online banking, it is very easy to monitor your payments and credit card usage.

Credit Score Improvement

Your personal credit score is very important and it is necessary to have a good score in order to get great deals on mortgages and other loans. To have a good credit score, you will first need to build your credit history and these cards can be a great way to do so if you manage your debt correctly.

Easy to Overspend

One of the biggest challenges with credit cards is that they make it very easy to spend money that you don’t have. Unlike using cash or writing a check, you will not see the money leave your account when you use a card to make a payment. Because of this, it is very easy to accidentally spend too much money on items you don’t need and cant afford.

Expensive

If you have a credit card, you should ideally payoff the balance in full at least once per month. If you do this, you will never incur any interest charges or late fees. However, once you start to fall behind on the balance, it can be very hard to get caught back up. With the very high interest charges, which can easily be higher than 20%, credit card debt can quickly accumulate. Furthermore, as your balance grows higher, and if you are late on payments, your credit score will end up taking a big hit and will drop.

If you do find that you are in credit card debt, taking advantage of a debt settlement plan could be a great option.