From Pixabay

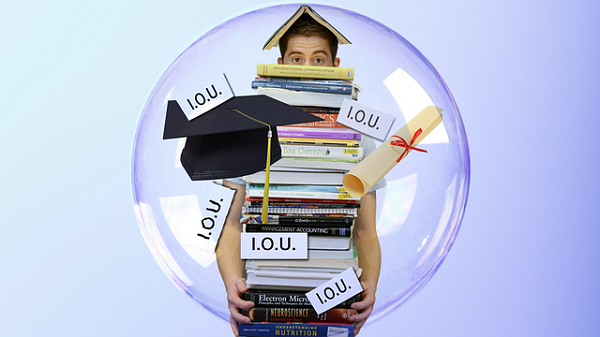

Although things have calmed down somewhat, student loans are still popping up on the news here and there.

We’ve all seen the figures, and know that students owe an incredible amount of collective debt. If you’re getting close to graduation day, and you’re finding the whole idea of this debt daunting, then I urge you to read on.

Here are my best tips for managing your student debt.

From Flickr

First of all, start paying it off today. Yes, the first payments might not be due for a long time. However, if you can start chipping away at your debt when you’re still a student, you’ll make paying off the rest a whole lot easier.

It will also help in shaving down your principal, and in turn the amount you need to pay in interest. Obviously, the student loan debt crisis didn’t come out of the blue. If it was that easy to pay off your debt while you learn, there would be far less graduates with financial problems.

However, if you can sacrifice a few luxuries, making small payments will help you out further down the line.

From Public Domain Image

The second tip I can offer is go looking for assistance. This may mean relocating, or taking a job in the public sector.

Several counties in the US are offering student loan assistance for graduates who are willing to move.

There are also national programs which will forgive debt for teachers at low-income schools, and a few other public sector jobs.

From Wikimedia

These options might not be a route into your dream career, true.

However, with some of the incentives being offered, you may not be able to afford to ignore them. Just bear in mind that most of them require a long-term commitment.

Taking one of these jobs or relocation programs should never be seen as a quick fix you can brush out of the way.

Having said that, you should still look into opportunities to further your career.

From Wikimedia

My final tip is another one which you can start on campus. Try to groom a good credit score. This may sound contradictory, but open a student credit card. If you manage to use it responsibly, this will show up positively in your credit reports, and your credit score will ultimately rise over time.

These days, a good credit score is one of the most valuable assets you’ll have in adult life. From insurance premiums to your mortgage to other loans, a good credit score will be beneficial in almost any financial situation.

Once you get a graduate-level job and are approved for a higher credit limit, you may also qualify for a balance transfer. This will allow you to transfer some of your balance to a credit card, and pay it off with a reduced interest rate.

Your credit score is going to be very important in later life, so don’t neglect it!

From Wikimedia

Having student loan debt hanging over your head isn’t nice, but it isn’t a fact of life.

Start making wise decisions now, and you’ll thank yourself later.