SMEs are the lifeblood of the UK economy. Last year, Britain’s small businesses recorded an estimated combined turnover of £1.5tn.

But with almost half of SMEs admitting to experiencing cash flow set-backs, and a fifth especially concerned about the next 12 months, balancing the books can pose a considerable challenge for SMEs.

The British economy is depending on its small businesses to prosper, so it is vital for companies to find a way of flourishing whilst still maintaining liquidity to deal with unexpected hurdles.

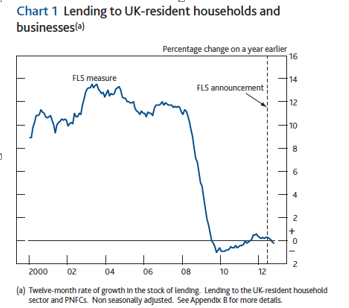

When the recession struck back in 2008, the level of funding from traditional banks to SMEs crashed almost overnight.

Source: News Release: Quarterly Bulletin 2012 Q4

Businesses relying on lending to maintain a healthy working capital were suddenly left unable to access necessary funds, exposing them to considerable financial risk.

So, what are the options for balancing business development with financial fluidity?

Budget

It sounds obvious, but you’d be surprised how often small businesses neglect to budget. The main goal of every business should be to maximise money coming in and minimise expenditure.

Only when current spend is analysed can future targets be established and a plan formulated for how they will be reached.

Fees Upfront

The prospect of asking for fees upfront can be daunting, and isn’t feasible for every small business.

But where it’s possible to demonstrate proven past results, sometimes clients will be prepared to pay a percentage up front to enable their provider to do the best possible job.

Utilising Savings

A fundamental error in uncertain economic times is to minimise spend on the things that are actually going to aid business growth, such as advertising, marketing and customer service.

Going down this route can actually cost the business more in lost sales and diminished brand reputation than is saved through the reduction in spend.

Invoice Finance

Recent research shows that the main reason for cash-flow problems in SMEs is unpaid invoices, with 24 per cent of businesses reporting they have experienced issues relating to late payment.

Invoice Finance, whereby businesses borrow money against commercial invoices for an instant cash-flow boost, has long been tarred with the ‘last-resort’ brush.

But actually, even the strongest small businesses can become a victim of cash flow, largely as a result of clients taking advantage of lengthy payment terms.

Maintaining a healthy cash flow is fundamental to successful business practise, so it’s advisable to combine a number of solutions to formulate a strategy that works for you.